-

Mumbai

- Login

- Register

Subjects and Syllabus:

The main focus is on basic knowledge of various topics in ten different aspects in order to simplify the analysis using investment tools. A candidate is hence introduced to various concepts in finance and investment.

| Topic Area | Level I | Level II | Level III |

|---|---|---|---|

| Ethical and Professional Standards | 15 | 10-15 | 10-15 |

| Quantitative Methods | 12 | 5-10 | 0 |

| Economics | 10 | 5-10 | 5-15 |

| Financial Reporting and Analysis | 20 | 15-20 | 0 |

| Corporate Finance | 7 | 5-15 | 0 |

| Equity Investments | 10 | 15-25 | 5-15 |

| Fixed Income | 10 | 10-20 | 10-20 |

| Derivatives | 5 | 5-15 | 5-15 |

| Alternative Investments | 4 | 5-10 | 5-15 |

| Portfolio Management | 7 | 5-10 | 40-55 |

| Total | 100 | 100 | 100 |

In order to obtain a charter degree candidate must pass all 3 levels of course

Structure: The Level I exam consists of 240 multiple choice questions, split between two 3-hour sessions. Candidates must attend both sessions.

Morning session (3 hours): 120 multiple choice questions, covering all topics

Afternoon session (3 hours): 120 multiple choice questions, covering all topics

Timing:On average you should allow approximately 90 seconds for each multiple choice question. You may need more or less time, depending on the question and how well you understand the topic.

Exam Question Format

Multiple Choice Questions

Each item on the Level I multiple choice exam consists of a question, a statement, and/or table and three answer choices: A, B, and C.

Each item on the Level I multiple choice exam consists of a question, a statement, and/or table and three answer choices: A, B, and C.

All questions are equally weighted and there is no penalty for an incorrect answer.

Exam Grading and Results

Level I exam results are available within 60 days following your exam.

Tips for Taking the Level I Exam

The student must be comfortable with the calculator. You should know how to use the calculator features needed to address the learning outcome statements (LOS).

Exam questions referring to Financial Reporting and Analysis (FRA) are based on International Financial Reporting Standards (IFRS) unless otherwise specified. When a question is based on U.S. GAAP, it will be stated in the question.

Answer all questions. There is no penalty (negative marking) for incorrect answers.

CFA level II :

Exam Structure and Timing

The Level II exam has a total of 21 item set questions:

Morning session: 10 item set questions

Afternoon session: 11 item set questions

On the Level II exam, you will have a total of 120 items (18 vignettes with 6 items each and 3 vignettes with 4 items each, for a total of 21 vignettes) compared to 240 multiple choice items on the Level I exam.

The Level II exam is worth 360 points, corresponding to the number of minutes on the exam. The 120 Level II items are equally weighted, 3 points each, with no penalty for incorrect answers.

On the Level II (and III) exams, some topics are covered in the morning session only and other topics are covered in the afternoon session only.

Exam Question Format

When you prepare for the Level II exam, remember to review the Level I question format details for multiple choice questions. This same question construction applies to the multiple choices presented in item sets.

Item Set Format

Item sets are sometimes called “mini-cases” Each item set on the CFA exam consists of a vignette (or case statement) and either four or six multiple choice items (questions).

The length of a vignette ranges from about 1 page to 2.5 pages. The average length of the vignettes on the exam is about 1.5 pages. The longer vignettes are those that include several tables of information, such as for a financial statement analysis, statistics, or fixed-income item set.

The multiple choice items in each item set can only be answered based on the information in the vignette. Hence, the items are not free-standing (as in Level I), but are drawn from the vignette. You will need to read the vignette before answering the items, and you will need to refer back to the vignette for information. The multiple choice items can be answered independently of each other, but they do require information provided in the vignette.

Exam Grading and Results

Level II exam results are available within 60 days following your exam.

Learn more about exam grading and see recent pass rates

Tips for Taking the Level II Exam

You may mark up your exam book. Circle or underline important information in the vignette and write down your equations or logic. However, only your answers recorded on the answer sheets are graded.

Exam questions referring to Financial Reporting and Analysis (FRA) are based on International Financial Reporting Standards (IFRS) unless otherwise specified. When a question is based on U.S. GAAP, it will be stated in the question.

Exam Structure and Timing

The Level III exam consists of item set and constructed response (essay) and item set questions:

Morning session: Constructed response (essay) questions (usually between 8 and 12 questions, each with several subparts) with a maximum of 180 points. (The point value for each question is provided in the exam book.)

Afternoon session: 11 item set questions (8 vignettes with 6 items each and 3 vignettes with 4 items each, for a total of 11 vignettes)

Exam Question Format

When you prepare for the Level III exam, remember to review the Level II item set question details.The Item set will be the same as in Level II.

Constructed Response (Essay) Questions

Each essay question has two or more parts (A, B, etc.) and one or both of the following types of designated answer pages:

One type of answer page is an unlined page, clearly labeled for that question part. You are free to write your response as needed on that page.

The other type of answer page has a structured set of boxes. The boxes are clearly labeled for that question part and provide a visual structure to guide you in writing your responses.

Your Essay Exam Book

Read and follow the instructions on the front cover and throughout the exam book.

Page one of the exam book lists all the questions on the exam as well as the topic and the minutes allocated for each question.

The heading where a question begins states the number of parts in that question and the total number of minutes allocated. For example: “Question 2 has two parts (A, B) for a total of 18 minutes”

Instructions in bold print immediately following the question direct you to the designated answer page for each question part. For example: "Answer 2A on page 17”

Candidate Survey Profile:

This survey is done by the CFA institute in order to know the feedback across several areas like exam preparation, charter value, exam day feedback, employment outlook.:

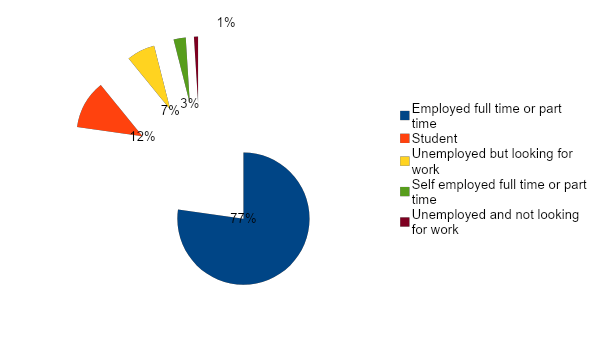

The june 2018 candidate survey represents a global community of current and aspiring investment professionals from age 21 to 76, from 184 international markets. 78% report have full or part time employment.

CURRENT EMPLOYMENT STATUS:

TOP JOB FUNCTIONS OF EMPLOYED CANDIDATES

Research Analyst Investment Analyst or Quantitative Analyst

Accountant Or Auditor

Corporate Financial Analyst

Consultant

Risk Analyst Manager

Relationship Manager / Account Manager

Credit Analyst

Portfolio Manager