-

Mumbai

- Login

- Register

The Chartered Financial Analyst Program is a professional certificate course offered by the CFA Institute. The main objective of the CFA Institute is to generate value for investment management professionals and engage them in the industry to follow ethics, market righteousness and professional standards of practice, which collectively adds value to society.The hardcore investment management professionals are those individuals who are primarily involved in activities related to the decision-making processes like portfolio management, financial advisory, and research analysis on both the buy and sell side. They also work as advisors for companies in wealth management.

The core investment management industry is comprised of firms which are engaged in asset management firms like mutual funds, hedge funds, private equity, real estate investment, investment research and ratings, and investment advisory services, wealth management, fiduciary asset ownership such as pension funds, endowments, and sovereign wealth funds, and their related regulators and standard setters.

| Deadlines |

Dec 2020

(level 1)

|

Feb 2021

(level 1)

|

June 2021

(level 2 and 3)

|

|---|---|---|---|

| Registration opening date | February 5, 2020 | June 16, 2020 | July 29, 2020 |

| Early registration deadline | March 25, 2020 | August 13, 2020 | September 23, 2020 |

| Standard Registration Deadline | August 19, 2020 | Not Applicable | February 17, 2021 |

| Final Deadline | September 9, 2020 | November 3, 2020 | March 17, 2021 |

| Exam Day | December 5, 2020 | February 23 to March 1, 2021 | June 5, 2021 |

Subjects and Syllabus:

The main focus is on basic knowledge of various topics in ten different aspects in order to simplify the analysis using investment tools. A candidate is hence introduced to various concepts in finance and investment.

| Topic Area | Level I | Level II | Level III |

|---|---|---|---|

| Ethical and Professional Standards | 15 | 10-15 | 10-15 |

| Quantitative Methods | 12 | 5-10 | 0 |

| Economics | 10 | 5-10 | 5-15 |

| Financial Reporting and Analysis | 20 | 15-20 | 0 |

| Corporate Finance | 7 | 5-15 | 0 |

| Equity Investments | 10 | 15-25 | 5-15 |

| Fixed Income | 10 | 10-20 | 10-20 |

| Derivatives | 5 | 5-15 | 5-15 |

| Alternative Investments | 4 | 5-10 | 5-15 |

| Portfolio Management | 7 | 5-10 | 40-55 |

| Total | 100 | 100 | 100 |

In order to obtain a charter degree candidate must pass all 3 levels of course

Structure: The Level I exam consists of 240 multiple choice questions, split between two 3-hour sessions. Candidates must attend both sessions.

Morning session (3 hours): 120 multiple choice questions, covering all topics

Afternoon session (3 hours): 120 multiple choice questions, covering all topics

Timing:On average you should allow approximately 90 seconds for each multiple choice question. You may need more or less time, depending on the question and how well you understand the topic.

Exam Question Format

Multiple Choice Questions

Each item on the Level I multiple choice exam consists of a question, a statement, and/or table and three answer choices: A, B, and C.

Each item on the Level I multiple choice exam consists of a question, a statement, and/or table and three answer choices: A, B, and C.

All questions are equally weighted and there is no penalty for an incorrect answer.

Exam Grading and Results

Level I exam results are available within 60 days following your exam.

Tips for Taking the Level I Exam

The student must be comfortable with the calculator. You should know how to use the calculator features needed to address the learning outcome statements (LOS).

Exam questions referring to Financial Reporting and Analysis (FRA) are based on International Financial Reporting Standards (IFRS) unless otherwise specified. When a question is based on U.S. GAAP, it will be stated in the question.

Answer all questions. There is no penalty (negative marking) for incorrect answers.

CFA level II :

Exam Structure and Timing

The Level II exam has a total of 21 item set questions:

Morning session: 10 item set questions

Afternoon session: 11 item set questions

On the Level II exam, you will have a total of 120 items (18 vignettes with 6 items each and 3 vignettes with 4 items each, for a total of 21 vignettes) compared to 240 multiple choice items on the Level I exam.

The Level II exam is worth 360 points, corresponding to the number of minutes on the exam. The 120 Level II items are equally weighted, 3 points each, with no penalty for incorrect answers.

On the Level II (and III) exams, some topics are covered in the morning session only and other topics are covered in the afternoon session only.

Exam Question Format

When you prepare for the Level II exam, remember to review the Level I question format details for multiple choice questions. This same question construction applies to the multiple choices presented in item sets.

Item Set Format

Item sets are sometimes called “mini-cases” Each item set on the CFA exam consists of a vignette (or case statement) and either four or six multiple choice items (questions).

The length of a vignette ranges from about 1 page to 2.5 pages. The average length of the vignettes on the exam is about 1.5 pages. The longer vignettes are those that include several tables of information, such as for a financial statement analysis, statistics, or fixed-income item set.

The multiple choice items in each item set can only be answered based on the information in the vignette. Hence, the items are not free-standing (as in Level I), but are drawn from the vignette. You will need to read the vignette before answering the items, and you will need to refer back to the vignette for information. The multiple choice items can be answered independently of each other, but they do require information provided in the vignette.

Exam Grading and Results

Level II exam results are available within 60 days following your exam.

Learn more about exam grading and see recent pass rates

Tips for Taking the Level II Exam

You may mark up your exam book. Circle or underline important information in the vignette and write down your equations or logic. However, only your answers recorded on the answer sheets are graded.

Exam questions referring to Financial Reporting and Analysis (FRA) are based on International Financial Reporting Standards (IFRS) unless otherwise specified. When a question is based on U.S. GAAP, it will be stated in the question.

Exam Structure and Timing

The Level III exam consists of item set and constructed response (essay) and item set questions:

Morning session: Constructed response (essay) questions (usually between 8 and 12 questions, each with several subparts) with a maximum of 180 points. (The point value for each question is provided in the exam book.)

Afternoon session: 11 item set questions (8 vignettes with 6 items each and 3 vignettes with 4 items each, for a total of 11 vignettes)

Exam Question Format

When you prepare for the Level III exam, remember to review the Level II item set question details.The Item set will be the same as in Level II.

Constructed Response (Essay) Questions

Each essay question has two or more parts (A, B, etc.) and one or both of the following types of designated answer pages:

One type of answer page is an unlined page, clearly labeled for that question part. You are free to write your response as needed on that page.

The other type of answer page has a structured set of boxes. The boxes are clearly labeled for that question part and provide a visual structure to guide you in writing your responses.

Your Essay Exam Book

Read and follow the instructions on the front cover and throughout the exam book.

Page one of the exam book lists all the questions on the exam as well as the topic and the minutes allocated for each question.

The heading where a question begins states the number of parts in that question and the total number of minutes allocated. For example: “Question 2 has two parts (A, B) for a total of 18 minutes”

Instructions in bold print immediately following the question direct you to the designated answer page for each question part. For example: "Answer 2A on page 17”

Candidate Survey Profile:

This survey is done by the CFA institute in order to know the feedback across several areas like exam preparation, charter value, exam day feedback, employment outlook.:

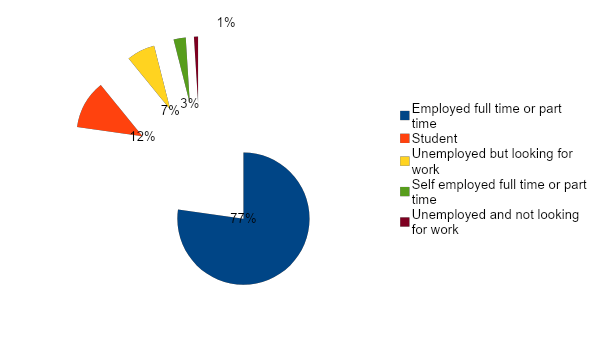

The june 2018 candidate survey represents a global community of current and aspiring investment professionals from age 21 to 76, from 184 international markets. 78% report have full or part time employment.

CURRENT EMPLOYMENT STATUS:

TOP JOB FUNCTIONS OF EMPLOYED CANDIDATES

Research Analyst Investment Analyst or Quantitative Analyst

Accountant Or Auditor

Corporate Financial Analyst

Consultant

Risk Analyst Manager

Relationship Manager / Account Manager

Credit Analyst

Portfolio Manager

You are eligible for CFA program if you are in your final year of bachelor’s program or you have completed your bachelors degree. If you are not pursuing your bachelor's degree and want to apply for the exams, you need to have professional working experience of 4 years which need not be investment related.

Have an international travel passport:

CFA® Institute requires the CFA program candidate must have a valid international travel passport to register and sit for the exam.

A Valid International Travel Passport:

This should be issued by a national government which certifies, for the purpose of international travel, your identity and nationality. It should be an original document and should be current (not expired);

Contains your name, date of birth, passport number, expiration date, and the name of the country that issued the passport;

Is machine readable (handwritten passports will not be accepted); and Includes a recognizable photograph on the passport data page. Is required when you register for the exam and during check-in for both the morning and afternoon sessions on exam day.

There is a one-time program enrollment fee required when you register for your first Level of CFA Program exam. You must pay the exam registration fee.

Program enrollment fee: USD 450

All registration deadlines end at 11:59 pm ET.

Exam Registration Fees and Deadlines for last attempt were :

June 2019 Exam (Levels I, II, III)

| Early Registration Fee | USD 650 | (ends 17 October 2018) |

| Standard registration fee | USD 950 | (ends 13 February 2019) |

| Late registration fee | USD 1380 | (ends 13 March 2019) |

December 2019 Exam (Level 1)

| Early Registration Fee | USD 650 | (ends 27 March 2019) |

| Standard registration fee | USD 950 | (ends 14 August 2019) |

| Late registration fee | USD 1380 | (ends 11 September 2019) |

The one time enrollment fee and the exam registration fees are payable in US dollars only and fees are non-refundable and non-transferable

In case you are not paying online with a credit card, then you must use the “Print Invoice” option during the checkout process and submit the invoice along with one of the accepted payment methods.

Your Invoice and/or Receipt

If you selected a method of payment other than a credit card, an invoice was mailed to you.

Download your invoice (login required) Once your payment has been processed, your receipt will be emailed to you.

Access your receipt online (login required)

Note: If you are registering for the CFA Program and you purchase the print version of the curriculum, it will be shipped within one to two business days after payment confirmation. Your curriculum should arrive within six to nine business days after shipment.

In case you do not clear a particular attempt then for you re-attempt only the registration fee will need to be repaid & not the program enrollment fee.

On an average the candidate spends 318 hours for preparing for exams , with Level III candidates reporting the most time preparing for the exam. The most commonly used study material was the CFA Institute curriculum (75%).

CURRICULUM AND EXAM VALUE:

The candidates are highly satisfied with the quality of the exam and exam administration experience , with 97% agreeing to the fact that CFA Program curriculum improved their understanding of important topic and 96% agreeing that the examples and practice problems at the end of the readings are helpful in explaining the concept.

CHARTER VALUE, PROGRAM AWARENESS, AND CAREER RELEVANCE

The candidates have rate the value of earning the charter very high: 9 out of 10. The main motive behind registering for such exam is that of career advancement , 85% said they are likely to recommend the CFA Program to someone else.

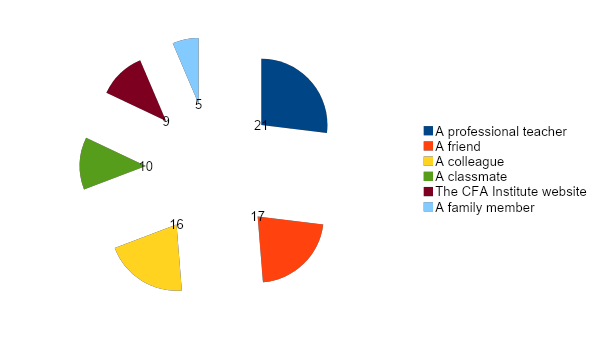

TOP 6 WAYS CANDIDATES BECAME AWARE OF THE CFA PROGRAM

EMPLOYMENT OUTLOOK

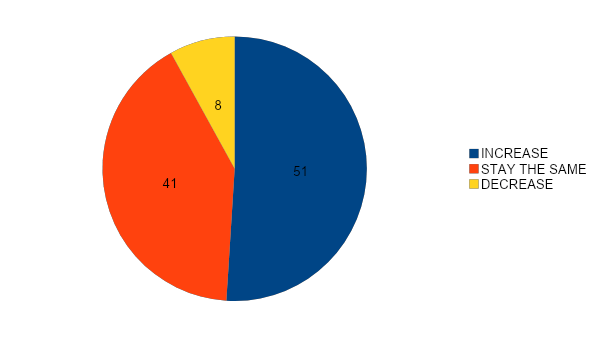

A survey conducted by CFA institute had asked various candidates that in coming 12 months do you expect employment opportunities for investment management professionals in your local market whether it will increase, decrease or stay the same?

TOP COACHING CLASSES IN MUMBAI:

The different points of views are articulated based on the reviews and comments by students on their experiences.This list are on the basis of parameters of the educator extensively acknowledged for and not a ranking.

Teaching quality & student satisfaction: Rajaram Kamat CFA Classes

Experience: Laukik Shah

Brand image: Rajaram Kamat CFA Classes

Student friendly: V D Shah

Online portal & Flexibility: Edupristine

IMS ProSchool

TOP COACHING CLASSES IN PUNE:

IMS Proschool:

The weekend batches are designed such that working professionals and graduates are not at a loss. The program is available across various mediums i.e., classroom sessions, live virtual sessions and distance/ self-study mode. Online and paper based study material is provided on candidates personal Learning Management System. The institute being mobile friendly the setup and applications is accessible for people who travel a lot. Also 3 full length mock exam, subject wise mock tests and quizzes.

EduPristine:

Edu Pristine provides 110 hours of exhaustive classroom training. The program is available in all mediums i.e. classroom sessions, live virtual sessions and distance/ self-study mode.

Study material is provided in the form of presentations. They also provide one full length mock exam, 40 hours of doubt clearing sessions and 22 days of Live Virtual Training if you opt for online classes.

Students can also have an online access to materials and recordings, doubt solving forum to interact with faculty and fellow students. The only hitch being that they do not have a student help centre in Pune since everything is controlled from Mumbai.

3.Profit Shastra

4. Fin Tree

CFA LEVEL I (EXAM PREPARATION STRATEGY AND LAST MINUTE TIPS)

If you feel like you’re running out of time to study for the CFA Program exam and you are behind on your study schedule than to increase your chances of passing, following are the last-minute CFA Program exam tips that can be followed and you can make the most of time left for studying.

1: Strategically Select Topics to Focus On

The Level I CFA Program exam is weighted by topic area, hence to increase your chances of success you can give weightage to your lessons similarly. Ethics being on all three levels of CFA Program should pay special attention to.

2: Put More Focus on Practice Problems

If you are late in the game than putting more focus on practice problems makes sense. You can use the questions to learn the concepts since there is not much time left to read the entire reading material. Answer the questions the best you can, and then make sure you’ve mastered the concepts embedded in the questions by going through the curriculum where those topics are covered.

3: Minimize Distractions

For last minute preparation you can minimize your distractions by using an auto-response to emails and texts. You can also minimize distraction by anticipating your internal needs (hunger, boredom, stress, sleep deprivation) and plan ahead.

4: Fill Small Pockets of Time with Studying

Work on flashcards or Question Bank while on the ride or while travelling back home from office and make the most use of time. Review study notes while exercising. Your study materials should be with you at all times you must utilize your time to the fullest.ered the concepts embedded in the questions by going through the curriculum where those topics are covered.

5: Use the 50/10 rule

Rather than half-studying with periodic distractions use a timer to study for 50 minutes of every hour with zero breaks or distractions and a 10-minute break. If you can train yourself this way, you will study hard 80% of the time, which is more effective than half-studying.

CFA LEVEL II

Topic Focus

In Level II it’s difficult to focus on a few topics as most of them are interrelated.

Ethics (10-15%) - because it's a must, and you just need to learn one or two new concepts and the rest is similar to Level I. Easy way to cover some ground.

Equity Investments and FRA(10-15%) - these are simply too big to ignore.

Fixed Income (10-15%) - CFA Institute has up weighted Fixed Income and it is also important in Level III - make sure you get enough focus here.

The rest You'll need to pick two or three more topics from the rest (all 5-10%) each. Choose your strong suit.

Format

For this level, the topic concentration works in your favour, but knowing that nearly all of Level III candidates perform worse in essay questions may discourage you at first. Following things can be done in order to maximize chances of passing.

Ethics (10-15%) - because it's a must, and they largely build on what you've learned in Level I-II. Easy way to cover some ground.

Portfolio Management(35-40%) - If there's one topic you need to cover (and only have time for) in Level III, focus on the varieties of Portfolio Management.

Fixed Income (15-20%) – One cannot escape from this asset class.

Format

Post Level I and Level II you are almost on the verge of being successful in completing Level III.The following tips must be followed in order to complete Level III.

Keep calm

The best advice is to keep calm as you enter the last stage of CFA Program especially when the exams are nearing. Your focus is shifted if you are more stressed. Make sure you have a study plan to go over all the material by dividing it into small pieces, putting more focus on areas of weakness.

Get planning

A study calendar will help organise and plan everything within a time frame. Plot your calendar so that you cover all elements, giving each the necessary time and allotting more time to any areas of weakness.

Practice makes perfect

Make sure you get plenty of practice on the calculator that you will be using in the exam. It is important to make sure that you know how to properly clear the calculator and that you do this every time before you start a calculation.

Train to sustain

Train yourself by practice test and mock exams on CFA Institute’s website in order to keep a track on your performance.

Target weak spots

In the final four weeks you should particularly target those topics that carry the biggest weight in the exam. From these topics make an assessment of which ones you feel that you have mastered, and those that you feel need more revision.

Do your paperwork

When you find a moment that you’re not using for study, have a think about your photo identification. It is important to make sure that it hasn’t expired and that the name on your admission ticket is an exact match for how your name appears on your ID. If there is any difference, now is the time to complete and submit a Name Change Form from the CFA Institute Candidate Website.

Have a go

There is no penalty for incorrect answers, so even if you’re stuck on a question, at least try to give it a go.

Watch the clock

Timing, as ever, is key to finishing the exam with all questions answered. Be aware that the morning section of Level 3 is seen as the most challenging in terms of time management as it involves essay writing. So stay one step ahead with Morgan’s tips for meeting this challenge head-on:

Do as you’re told!

It’s supremely important that you follow the instructions in the exam. For example, if the question tells you to “show your work” then you should do exactly this and present your calculations. The good news is that sometimes partial credit is given when correct formulas or inputs are shown even if the answer itself is incorrect.

Pay attention

It pays to read the instructions on the front cover and throughout the exam book. Make sure you read them thoroughly and this will help you avoid missing any parts, answering sequential questions in the wrong order, or filling out your answers on the wrong pages.

Be clear

Although it’s OK to use common abbreviations and symbols, if you are in any doubt it is better to write it out in full.

Keep it focused

You will score points for direct answers to a question, but you will not score points for inserting general knowledge that does not address the question. So keep it focused!

Beware the bold

When a question features bold command words, remember to address them. These command words are defined on the inside front cover of the exam book. Take a look at LOS command words ahead of the exam. If the command words require a decision (for example Determine or Recommend), you must clearly state your choice or select it for template questions. If your intent is unclear or your answer contradictory, you will not receive points. When asked to “Justify a recommendation”, for example, make sure that you do just this with clear reasons or supporting arguments.

Be clear

if you change an answer, make sure you cross out the previous answer so that it’s clear to the grader which one to mark. Also, remember to be clear in your answers and avoid contradicting yourself.

Take care

Make sure you read each question carefully; if you rush through, you may find yourself tripping up on incorrect answer choices.

Keep it within reason

Everything that you need to formulate an answer already exists within the question information and the curriculum you’ve covered. Don’t introduce information outside this as the questions are rarely designed to trick you in such a way. Only introduce information that is directly relevant to the question asked, even if you are tempted to expand on this to show your knowledge.

And keep it simple

Do exactly what is asked of you and no more. If you are asked to give one reason or two advantages, do just this. If you add on more, only the first ones will be graded. So not only is it a waste of your time, but the correct ones may be missed further down. If you feel the need to state assumptions to support your approach to the answer, then do so.

Take note

Your exam book can be written in if you want to underline information or work out your equations, but take note that only your final answers present on your answer sheets will be graded.

Start with the obvious

If you are stuck on a question, begin by knocking out any answer that is obviously incorrect. This way you increase your odds of answering the question correctly. And, if you have to guess, make sure that logic and reasoning factor into your answer.

Mark as you go

Don’t leave the answer sheet till the end as you risk running out of time. As you complete each question, mark your answers on the answer sheet – it’s the safest strategy!